Sustained demand for budgeting help in Central Otago

Anna Robb

24 March 2022, 5:30 PM

Prices rising for petrol and diesel are putting increased pressure on families in Central Otago. PHOTO: File

Prices rising for petrol and diesel are putting increased pressure on families in Central Otago. PHOTO: FileCentral Otago residents are struggling to make ends meet as the cost of living continues to rise.

Central Otago Budgeting Service (COBS) office manager Pam Hughes said in the last financial year the service assisted almost 630 clients and this financial year was set to be on par.

“The numbers do vary all the time, but it’s looking similar this year.

“People are struggling with the general cost of living.”

She said some businesses were making some redundancies, which was hitting people in our area.

Another flow on effect of job losses, is increased requests for help on the insolvency side of things, including debt repayment orders, no asset procedures and full bankruptcy situations.

Pam said petrol prices were contributing to people ‘hunkering down’, being hesitant to take their car places or trying to combine trips to get more bang for their buck.

A fuel pricing poll* by Consumer NZ found four out of five respondents (or 81 percent) are driving less due to the price of petrol and diesel hitting painful levels.

Consumer NZ chief executive Jon Duffy said with the price of fuel past $3 a litre in most parts of the country, it was inevitable that there would be many New Zealanders looking to minimise their driving.

"A lot of people don’t have a choice, they can’t afford their fuel bill right now.

"We know a lot of New Zealanders are really feeling the pain at the pump right now and it’s worsened by increased price pressure across other essentials like groceries, power and rents,” Jon said.

Along with petrol, Pam said health issues were impacting on finances for some clients, who have been reluctant to go to the doctor due to the Covid-19 environment causing increased anxiety and caution.

“I think people are stressed because they don’t know which way to go, or where to turn for help.

“We’re seeing complex situations . . . finance can be a key issue, but also not the main issue.

“So many different things could be happening in families and environments, so we can refer [clients] on to other agencies to help.”

Pam said COBS was thinking outside the box to continue to operate even if they could not meet in person with people.

“We’re still seeing clients; we can work over the phone and via email or text. It might be dropping forms off to letterboxes, and clients signing them and sending a photo back.

“If you’re sick or isolating we can still do what we can to help.

“People may be unaware of things that they could be entitled to . . . often it is the simple things that we are looking at.”

Accommodation supplement and rates rebates, which both factor in family make-up, along with working for families are some ways people can get assistance.

As winter approaches, Pam urged people to buy their firewood now to give it time to dry out.

“We’ve been lucky with the weather . . . [although] soon people will be chewing though the power as they’re staying home more.

“I’d advise people to look at what power companies are around, and we can help you to decide what one is best for you. It’s also time to get your heat pump cleaned.”

Pam said the workload for COBS was currently manageable as the service has four part time staff ensuring adequate cover.

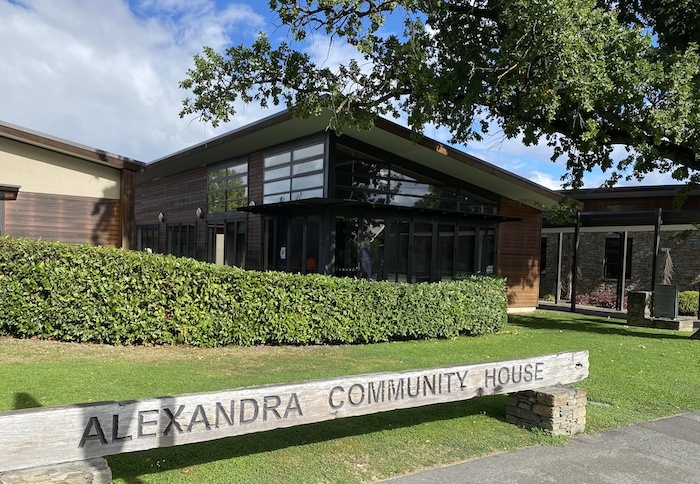

Central Otago Budgeting Services, based in Alexandra Community House on Centennial Ave, is assisting people during tough financial times. PHOTO: Anna Robb

*Consumer NZ Fuel Price Poll was conducted between March 12 and 16 2022 online, with 390 respondents.